OUR PERFORMANCE RESULTS

As experienced asset managers, we a Invest Sante SCA value measuring the success of the investments we manage for our clients. In order to ensure the highest level of transparency, we have analysed the actual returns of our client portfolios and had the results and methodology audited by the auditing firms KPMG & BDO Switzerland.

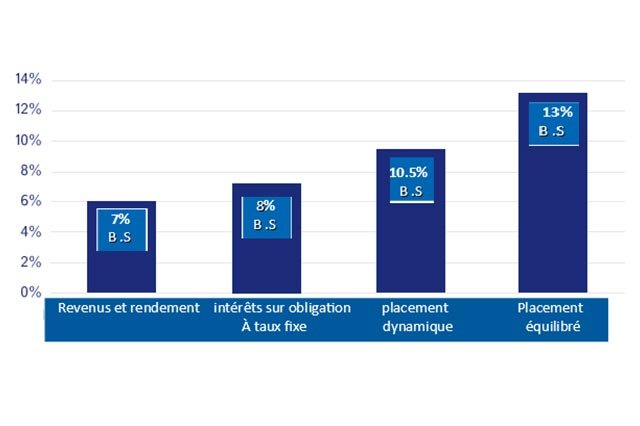

INVESTMENT PERFORMANCE

Client portfolios whose assets are invested in corporate bonds and/or investment funds which solely invest in corporate bonds.

STRATEGY 2

Client portfolios whose assets are invested to a maximum of 30% in equities, equity funds and alternative investments. The remaining assets are invested in corporate bonds and corresponding funds.

STRATEGY 4

More than 70% of the assets of these client portfolios are invested in equities, equity funds and alternative investments.

Client portfolios whose assets are invested to a maximum of 70% in equities, equity funds and alternative investments. The remaining assets are invested in corporate bonds and corresponding funds.

INVESTMENT PERFORMANCE

*The historic data is no guarantee of future performance. The above-mentioned performance results are net results (after deduction of all fees but before tax) and refer to all client accounts of Invest Sante SCA the parent company of Invest Sante SCA is an independent company. However, it operates with the same expertise and methodology in the same investment universe.

METHODOLOGY

All client portfolios have been assigned to one of four categories according to their respective investment focus. Then, the performance of the four strategies was determined over the period 2015 to 2020, i.e. over 5 years. Performance has been calculated in euros on the basis of market prices after deduction of costs but before taxation. For the yield results, these are time and volume weighted values (for explanations see “Assumptions”)

MANAGEMENT ASSERTIONS

The performance values were determined on the basis of the following key assumptions:

- The performance calculation was carried out in Euro on the basis of market prices after charges and before taxes.

- The yield results correspond to volume-weighted values. Thus, the performance of a client portfolio with managed assets totalling 1 million Euro has twice as great an impact on the portfolio performance as a client portfolio with only 500,000 Euro under management.

- The performance of the portfolios was calculated using a time-weighted methodology. Inflows and outflows from client portfolios were thus taken into account.

- To allow time for the investment process, the performance was calculated for the quarter following the transfer of the assets. Such an approach is necessary since performance values concern actual realised values and not purely theoretical values.

- The calculation of the portfolio performance encompasses all client accounts at Development and Financing Holding S.A in the respective category. Only around 1% of accounts were left out of the equation due to accounting reasons which would make accurately determining the performance unfeasible.

CONFIRMATION BY KPMG & BDO*

The renowned auditing firms KPMG SA (Geneva) & BDO Switzerland checked all the performance values determined by Invest Sante SCA including all accompanying statements from the management, in accordance with the International Standards on Assurance Engagements 3000 (ISAE) and drew up a report with their findings. KPMG & BDO confirm while taking into consideration the criteria specified by Invest Sante SCA that the performance figures of the various client portfolios for the period of 2014 to 2018 were properly calculated and presented. We will gladly provide a copy of the entire auditing report to those who are interested.International Standards on Assurance Engagements) et ont fournis un rapport à ce sujet. KPMG et BDO Suisse concluent que les performances des différents portefeuilles des clients pour la période 2016 à 2019 ont été déterminées et présentées de façon réglementaire par Invest Sante SCA en tenant compte des critères spécifiques. Nous mettons à la disposition des clients intéressés les rapports complets de KPMG et BDO Suisse.

* KPMG International is a global network of legally separate and independent companies operating in the fields of auditing, tax advice and business/management consultancy and is based in Zug, Switzerland with operational headquarters in Amstelveen. The name of the company is based on its founders, Klynveld, Peat, Marwick and Goerdeler. With around 162,000 employees at locations in 155 countries and a total of USD 24.8 billion in turnover (2016)[4], KPMG is one of the ‘Big Four’ international auditors. The European group parent company, KPMG Europe LLP, has 32,300 employees across more than 143 locations and achieves turnover of EUR 4.997 billion (2016)[4], making it the largest auditing firm in Europe.

For BDO Switzerland 33 locations provide the basis for their national network. BDO offers the most extensive network of offices in the industry. The global BDO network is represented in 154 countries with 1,634 offices and more than 64,300 employees. BDO is the leading international network for medium-sized enterprises.